How to file KRA nil returns for unemployed with pin

Why you need to file nil returns

If you are unemployed and you have a KRA pin you need to file your returns because KRA will fine you ksh 1000. If you don't declare that you are unemployed.

This will normally apply if you are a University student or you lost your job and employer is no longer paying for your Tax.

This will normally apply if you are a University student or you lost your job and employer is no longer paying for your Tax.

Steps for filling Nil returns

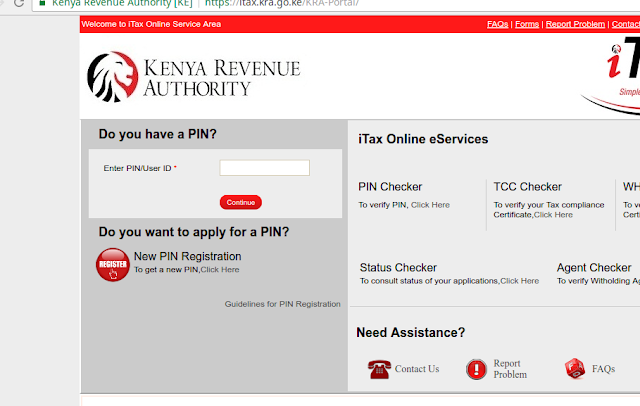

1) Step 1. Going to KRA

You are required to go to official kra website and log in, this is the URL for the site kra portal. After login you will be required to input user id or kra pin and pass word

2) Step 2

Input you pin and you will be directed here. Input password and security question. if You forgot password click on link to change.

Step 4,

There will be a drop down menu please select “file nil returns” |

| Add caption |

5) step 5. Filling type

You will leave the type blank, pin will be automatically there, select on the TAX-RESIDENT INDIVIDUAL on obligation type on the last drop down menu.6) Step 6; Filling the period

On the last step leave empty the wife section if you are not married select the date to be 1/1/2016, and last day will be filled automatically. As per now this is the year we are filling

7) Step 7; finishing

After submitting your returns you will be given a link to download your receipt

NB: If you have any question please leave your comment below

I am glad to find amazing information in your blog. Thanks for sharing the information. Tax IT company

ReplyDelete